CM Punjab Asan Karobar Scheme: Small and medium enterprises (SMEs) are the backbone of Punjab’s economy, yet many struggle with financing. The CM Punjab Asan Karobar Scheme is a revolutionary initiative aimed at providing interest-free loans up to Rs. 1 million, enabling entrepreneurs to expand and sustain their businesses. If you’re an aspiring or existing business owner, this guide will walk you through how to apply for the Asan Karobar Scheme online and benefit from this opportunity.

Benefits of Asan Karobar Card

The Asan Karobar Card provides financial assistance to entrepreneurs through interest-free loans. Here are some major benefits:

- Interest-free loans up to Rs. 1 million

- Flexible repayment plan with a grace period

- Quick and hassle-free application process

- Government-backed financial support for SMEs

Eligibility Criteria for Asan Karobar Scheme

To apply for the CM Punjab Asan Karobar Scheme, you must meet the following eligibility requirements:

- Pakistani citizen and resident of Punjab

- Age between 21 to 57 years

- Must have an existing or proposed business in Punjab

- Valid CNIC and registered mobile number

- No history of loan default

How to Apply Asan Karobar Scheme Online

Follow these steps to apply for the CM Punjab Asan Karobar Scheme online:

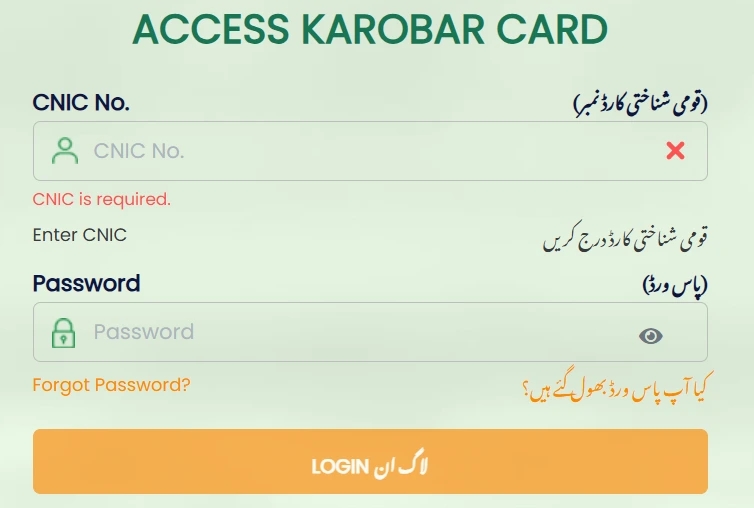

Step 1: Visit the Official Website

Go to the Punjab Government Portal and click on the application section.

Step 2: Sign Up or Log In

- Create an account using your CNIC and registered mobile number.

- Verify your identity through OTP authentication.

Step 3: Fill Out the Application Form

- Enter your personal details and business information.

- Upload the required documents as per the checklist.

Step 4: Submit the Application

- Double-check all details before submitting.

- After submission, you will receive an Application Reference Number for tracking.

Step 5: Verification and Approval

- Authorities will verify your documents and business feasibility.

- Upon approval, the loan amount will be disbursed to your bank account.

How to Pay Asan Karobar Fee Online

A processing fee of Rs. 500 is required to complete your application. Here’s how you can pay online:

- Log in to the official Asan Karobar Portal.

- Generate PSID (Payment Slip ID).

- How to Pay Asan Karobar PSID:

- Through online banking (select “Govt Payments” option)

- EasyPaisa/JazzCash (enter PSID and confirm payment)

- ATM or bank branch (use PSID for direct deposit)

Loan Disbursement and Repayment Plan

- Loan Amount: Disbursed in a lump sum after approval.

- Grace Period: No repayment for the first 3 months.

- Repayment Term: Payable in 24 equal installments.

- No Interest: 100% interest-free financing.

- Repayment Methods: Online banking, JazzCash, EasyPaisa, and bank deposits.

Conclusion

The CM Punjab Asan Karobar Scheme is an incredible opportunity for entrepreneurs to secure interest-free loans and boost their businesses. By following the Asan Karobar Scheme online application process, eligible individuals can easily access funding.

Make sure to pay your Asan Karobar PSID on time and complete all required documentation to ensure a smooth application process.

For more details, visit the official website and apply today!

What is the CM Punjab Asan Karobar Scheme?

The CM Punjab Asan Karobar Scheme is a government initiative designed to provide interest-free loans to entrepreneurs in Punjab. The scheme consists of two components: the “CM Punjab Asaan Karobar Finance” for larger loans and the “Asaan Karobar Card” for smaller financing needs

What are the main benefits of this scheme?

The primary benefits include 100% interest-free loans ranging from Rs. 10 lac to Rs. 3 crore, easy installment plans, simplified application procedures, and no immediate requirement for NOCs, licenses, or approved maps to obtain financing

Who is eligible to apply for the Asan Karobar Scheme?

To be eligible, you must:

Be between 21 and 57 years old

Be a Pakistani national residing in Punjab

Have a valid CNIC with a mobile number registered in your name

Either own an existing business or plan to start one in Punjab

Have a clean credit record with no overdue loans

Can I apply if I don’t have an existing business?

Yes, registration with either the Punjab Revenue Authority (PRA) or Federal Board of Revenue (FBR) is mandatory within six months of card issuance